eMobility in Japan is unpopular, and it’s barely improving for the last 3 years! There are several reasons for this phenomenon, some of which we already tackled several in previous articles. For this reason, we will focus on 5 disadvantageous examples regarding EV Charging in Japan and conclude whether Japan should replace CHAdeMO for the GB/T or the NACS EV charging standard!

- Japan’s EV charging standard > CHAdeMO

Japan is still using the CHAdeMO EV charging standard, with a maximum charging output of 150kW. This is not state of the art anymore, especially since companies like BYD or Contemporary Amperex Technology Co. Limited (CATL) from China showcased new battery technologies allowing EVs to get recharged with an over 1000 kW charging rates!

It’s known that the CHAdeMO Association itself worked with the China Electricity Council (CEC) in creating a mutual EV charging standard and expanding with it worldwide. This EV charging standard was called ChaoJI, but since the end of 2023, there have been no more news nor official statements of neither of the involved sites. In the meantime, we can observe how EV charging speeds of GB/T plug-equipped EV Charging stations across China are increasing, while Japanese EV CHAdeMO charging stations are still limited to 150kW.

So the biggest question is, why does the Japanese government still stick to the obvious outdated CHAdeMO EV charging standard if there are several better alternatives like the North American Charging Standard (NACS), the Combined Charging System (CCS) or the Chinese GB/T DC EV charging standard?

- No pressure from the international automotive industry but from Tesla Motors

Japan is and has been the only country in the world to use CHAdeMO as its primary EV charging standard. But still Japanese automotive OEMs were offering their EVs until a few years ago globally only equipped with the Japanese EV charging standard.

- Why did no other automotive OEM, but Tesla Motors, go into the Japanese EV Market and build up its own 250 kW fast EV Charging Network to establish its own charging standard in this case with the North American Charging Standard (NACS) in the country?

- Why did the Volkswagen Group hesitate and stopped their approach of sending CCS-equipped vehicles to Japan, as they already applied back in 2026 for Patents of CHAdeMO to CCS adapters? From this, the conclusion is that the company group planned to deliver the CCS-equipped vehicles to Japan. Interestingly, this Patent got only approved on January 2nd, 2025. Here you can find the patent in German, English, and Japanese.

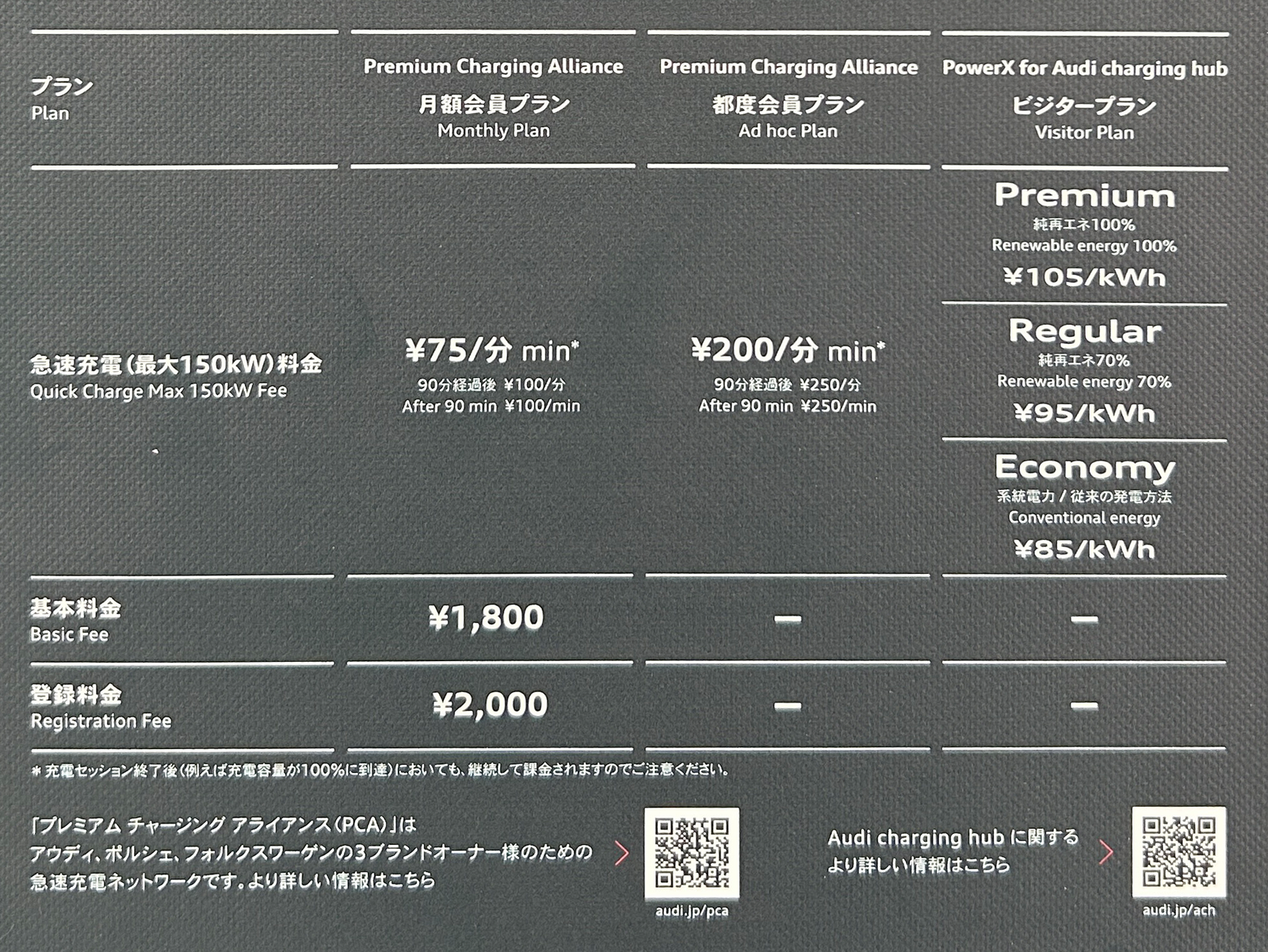

- Why are foreign EV manufacturers offering their vehicles in Japan voluntarily with reduced charging speeds like the Porsche Taycan, Audi e-tron GT, Mercedes EQ Series or Rolls-Royce Spectre to only 150kW? Porsche Japan and Audi Japan are building up their own EV Fast Charging Network, the Premium Charging Alliance (PCA), offering high-speed charging rates of only 150kW. Concerning this project, involved parties have installed certain EV chargers reaching top speeds of up to 180 kW. Why did they reduce their charging speeds, and why did they install them in the first place if they could have installed EV charging stations offering charging speeds of up to 300 kW using the CHAdeMO 2.0 protocol (which supports up to 400 kW charging speeds)?

- Lack of EV Charging Stations + Home Charging

There are not enough and well-maintained EV Charging stations in Japan. First, the parking situation in Japan differs completely compared to the rest of the world:

- Parking spaces on the side of the road are the exception, and by Japanese standards, parking in parking garages or parking lots is expensive.

- Many parking garages in Japan’s major cities are “Carousel Tower parking garages,” where it won’t be able to install EV Charging infrastructure.

- Japan is using a 100 V AC grid for standard households; in order to charge an electric vehicle at home, the wiring of a house might have to be upgraded. Older houses could be only equipped with a single-phase 2-wire system (100V), so it would have to be updated to a new single-phase 3-wire system (200V), including a new electric power connection to the grid. Only this would allow an owner of an EV in Japan to charge a vehicle with up to 9.6 kW, which is still relatively slow compared to European 3 Phase 220 V installations delivering up to 22 kW electricity per hour.

- EV Charging Pricing

In Japan, EV charging is billed per minute — and that’s where the trouble starts. Once again, we are witnessing the worst mistakes of EV history repeat themselves. The longer your car takes to charge, the more you pay. If your EV or the charging station operates slowly, your costs soar even higher!

Comparison: Audi Q4 e-tron vs. Audi Q5 TDI quattro 150 kW

- Audi Q4 e-tron: Charging a fully depleted 76.6 kWh battery pack from 0 to 100% takes approximately 60 minutes. The Ad-hoc charging price at PCA stations is 200 JPY per minute. This totals 12,000 JPY or approximately 73.22 EUR for a full charge.

- Driving Range and Cost: With an average consumption of 20 kWh per 100 km, the Q4 e-tron offers a theoretical range of 383 km per full charge. Therefore, 100 km will cost around 3,133 JPY or 19.11 EUR!

Now, let’s compare this with its diesel-powered sibling:

- Audi Q5 TDI quattro 150 kW: It has a fuel tank capacity of 65 liters and an average consumption of 6 liters per 100 km. This gives it a range of approximately 1,080 km on a full tank. With diesel priced at 167 JPY (around 1.02 EUR) per liter, driving 100 km costs only 1,002 JPY or 6.11 EUR.

Bottom Line: Charging and running an EV like the Audi Q4 e-tron in Japan can be over 3 times more expensive compared to fueling and driving its diesel counterpart — a price difference of 312.76%*

*Of course, these prices can be reduced through contracts with EV charging providers, which would lower the costs at PCA. However, even then, the costs remain higher than for a diesel vehicle.

- Tesla’s Super Charging in Japan

For instance, recharging a Tesla Model Y Standard Range with a 57 kWh HV battery in Japan from 5% to 100% takes approximately 47 minutes. The charging cost per minute ranges from 45.00 JPY to 245.00 JPY.

- Best-case scenario: The total cost would be 2,117 JPY (around 12.90 EUR).

- Worst-case scenario: The total cost would be 11,515 JPY (approximately 70.26 EUR).

Charging Costs per 100 km:

- Best-case scenario (45 JPY per minute): The cost per 100 km would be approximately 558.45 JPY (around 3.41 EUR).

- Worst-case scenario (245 JPY per minute): The cost per 100 km would be approximately 3,037.50 JPY (around 18.71 EUR).

Note: If the vehicle comes with unlimited Supercharging included, the costs for charging are waived entirely.

The only issue is that Tesla’s own EV charging network is not compatible with CHAdeMO standard-equipped vehicles at this time, while all NACS and Type-2 equipped Tesla vehicles are compatible with all CHAdeMO EV charging stations via a DC charging adapter!

So which EV Charging Standard should be adopted in Japan?

- In every case, it does not make any sense to further invest in the CHAdeMO EV Charging Standard — not for the CHAdeMO Association, nor for any other automotive OEM in the world. Logically, it would make the most sense to retrofit all CHAdeMO charging stations in Japan to NACS, as Tesla, as a CPO, is operating the largest, fastest, and most reliable EV charging network across not only in Japan, but also in South Korea, and Taiwan. This is one market, as NACS is used in all of them by Tesla. This would create the need to develop an official NACS-to-CHAdeMO adapter with interpreter retrofit kits, which could also be adapted to the CCS-2 standard to further secure the use of existing CHAdeMO vehicles around the globe. But there could be an easier solution — probably one that only Tesla Motors would not appreciate.

- Japan could implement GB/T EV Charging standard on the DC side. CHAdeMO and GB/T DC both use CAN-bus communication between the EV and the charging station. They are similar to each other, and both the CHAdeMO Association and the China Electricity Council (CEC) have already cooperated in the past on ChaoJI. So, these two players could cooperate again with a little push from both of their governments. Alternatively, the Japanese government could directly negotiate a deal with the CEC on this matter.

This could be the benefits of a GB/T DC adoption in Japan

For most of the EVs sold in Japan, a GB/T version exists, and retrofitting these vehicles at least on the DC side would be cost-effective and easy, as the original onboard charger of a CHAdeMO-equipped vehicle would remain the same, as would the J1772 charge port for AC charging. It would only require a quick DC charge port replacement and a firmware flash so that a CHAdeMO vehicle would accept the GB/T DC charging protocol.

The advantages for the Japanese automotive industry would be immense. More and more Japanese OEMs are cooperating with Chinese OEMs to develop new EVs and to become more competitive against their Western counterparts in the field of e-mobility. Also, they could hold on to their former goals with ChaoJI to make GB/T interoperable (to enable EV charging cross-compatibility) with other EV charging standards.

This would benefit China, as all of its neighboring countries are either using the Combined Charging System or NACS. If the CHAdeMO Cooperation adapted GB/T DC, this would finally allow all Japanese and Chinese-spec vehicles to be used all around the world, similarly to when Tesla Motors, back in the day, retrofitted all Type-2 vehicles either to CCS-2 or GB/T AC & DC — but some additional work would have to be performed for this.

Another positive effect would be that all public CHAdeMO EV charging stations worldwide could be retrofitted to GB/T, which is essential for the free travel of EVs, as more and more South American and Eastern European countries are already establishing large GB/T charging networks alongside the already existing CCS or NACS networks in those countries. This would lower the risk of accidents for EV users, who are currently forced to use uncertified and untested EV charging adapters.

The final benefit for Japan would be that they could retrofit, upgrade, or replace all of their CHAdeMO charging infrastructure with cost-effective EV charging equipment from China and gain access to BYD’s 1000 kW EV charging stations.

As Japan, through Panasonic, helped China modernize its industry, China could now return the favor by helping to improve Japan’s e-mobility market.

Only one question will remain: Will Japan adopt NACS, GB/T DC or stay with CHAdeMO?